If you pass the Substantial Presence Test (SPT) and are a Resident Alien (RA) for tax purposes, you do not have to submit a form W-8BEN. If you are Nonresident Alien (NRA) for tax purposes, you need to complete the W-8BEN and include it with your submission of tax documents to ISS. The link to the W-8BEN downloads directly from the IRS website, which is the latest form. Do not use old forms or download forms that are not from the IRS website. Use the guide to fill out your W-8BEN.

- Name of individual who is the beneficial owner: Enter your full name.

- Country of citizenship: This should match the passport you use with your tax documents.

- Permanent residence address: This is the address of where you live permanently and would normally pay taxes. It may be different from your country of citizenship.

- Mailing address: If you are currently in the U.S., you may enter your U.S. mailing address. If you no longer live in the U.S., then enter your mailing address outside the U.S., if different from your permanent address.

- Taxpayer identification (SSN or ITIN), if required: Enter your SSN or ITIN if you have one. You must enter this information if you are claiming tax treaty benefits.

- Foreign tax identifying number (see instructions): leave blank. 6b. leave blank

- Reference number(s): leave blank

- Date of birth: leave blank

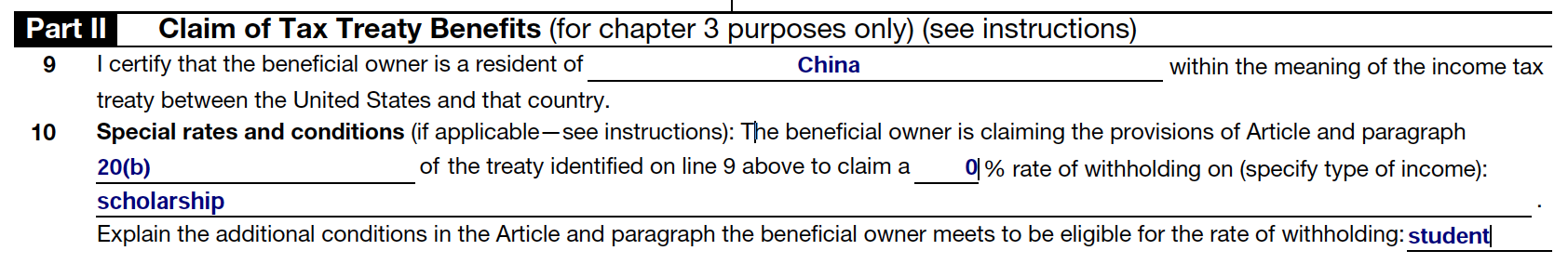

Skip this section if you cannot claim a tax treaty benefit. Go to Part III. If you do not know if you can claim a tax treaty benefit, go to the Tax Treaty Countries with Scholarship Benefits to see if you have an applicable tax treaty benefit for scholarships, and use the information article information from that page. A sample is provided.

- I certify that the beneficial owner is a resident of...: Enter the country for which you are claiming a tax treaty benefit.

- Special rates and conditions: Enter the treaty article in the first blank after "provisions of Article and paragraph." In the next blank, enter "0" rate of withholding. In the third blank, enter “scholarship." In the fourth blank, enter “student.”

If you are signing for yourself, you do not need to check the box for “I certify that I have the capacity to sign for the person identified on line 1 of this form.”

Sign, date, and print your full name on the lines provided. You may digitally sign this form to submit, or submit a scan of an original form signed in wet ink.

Once you have completed the form, return to Directions for Processing Scholarship Overawards to continue.