Frequently Asked Questions

Manually scroll down or click item below to jump to desired FAQ category:

- General FAQs

- Establishing KFS Accounts

- KFS eDocs

- RCUH

- Transfers

- Right to Use Accounting

___________________________________________________________________________________________________________________

General FAQs

Do I need to review and reconcile my general ledger account activity?

General ledger accounts help facilitate stewardship and compliance with legal and other reporting requirements of the financial transactions of the University. As part of a system of internal control, general ledger accounts must be reviewed, and the balances must be appropriately reconciled on a periodic basis.

Reviews should include the following depending on the account activities:

- Asset and liability balances should be reconciled to subsidiary ledger details.

- Transactions posted to the continuation accounts should be reclassified to an appropriate account.

- Revenue and expense balances should be reviewed for completeness and proper authorizations.

- Cash deficits should be cleared in order to reflect the true cash balance of the business unit(s).

- RCUH “7232” advances should be reconciled to the RCUH ledger, and appropriate reclassifications recorded in KFS.

If you have any questions, please contact the General Accounting Office at uhgalc@hawaii.edu.

Is it ok for me to approve the edocs I initiate?

Segregation of duties is a key component of a strong internal control system. Therefore, the KFS eDoc approval process is designed to ensure that every financial transaction is subject to a second party review by an individual who understands the business activity and the impact of the transaction. Fiscal Administrators are closest to their programs and have the best understanding of their program’s business activities, requirements, and restrictions. Therefore, KFS has been enhanced to require FA approval for all adjustment eDocs.

The adjustment eDocs affected by this enhancement are:

- Distribution of Income and Expense (DI)

- General Error Correction (GEC)

- Transfer of Funds (TF)

- Internal Billing (IB)

As a result, GALC will no longer approve DI, GEC, TF, and IB documents. KFS users are not authorized to approve any document that they initiate. In most cases, the automated workflow routing process will ensure that the approver is someone other than the initiator. However, Fiscal Administrators who submit adjustments on their own accounts will need to assign account delegates to approve transactions that they initiate if the adjustments only affect their account codes and if it is not practical for another individual to initiate the eDoc.

Persons assigned to initiate and approve financial transactions must be knowledgeable about the program’s business and have an understanding of the transactions they are initiating/approving. Certain eDocs, due to their inherent risk, may require additional approvals by the department and/or by central offices.

To provide transparency and accountability of the UH financial transactions, the Financial Management Office has developed the KFS Financial Transaction eDoc Approval Matrix that is posted on its website. Should you have any questions regarding KFS eDoc approval, please contact the General Accounting Office at uhgalc@hawaii.edu.

___________________________________________________________________________________________________________________

Establishing KFS Accounts

What is the process for establishing a new General Fund account?

The process for establishing a new General Fund account is as follows:

To expedite establishment and utilization of new General Fund accounts, General Accounting (GA) will no longer require the FA’s approval for the establishment of the related Non-Imposed fringe (NI) accounts. The new workflow will be as follows:

- FA submits KFS eDoc to create a new General Fund account.

- GA reviews, assigns account number, and approves.

- GA creates and approves the related NI account; e-doc will be routed to the FA to acknowledge.

- GA initiates and edits the new General Fund account’s attributes: Non-Imposed Fringe Indicator (Y), Fringe Benefit Account Number (new NI account), and Fringe Benefit Chart of Accounts Code (NI); e-doc will be routed to the FA for approval.

It is important for FAs to ensure that all steps are completed prior to incurring payroll charges in the new General Fund accounts. If all steps are not completed, the new General Fund account operating chart will incur the fringe benefit charges. General Accounting will then need to work with the FA to reverse the fringe benefit charges from the operating chart and post to the NI chart.

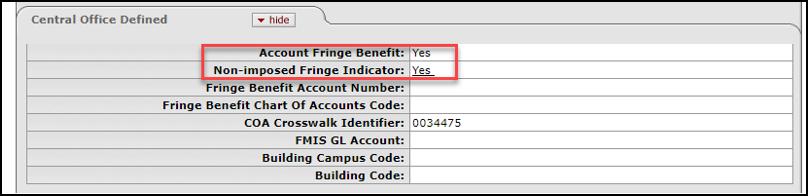

If the new General Fund account shows the following attributes, the account is not ready for use.

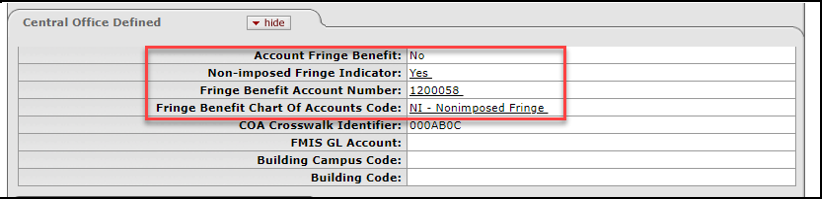

When the new General Fund account shows the following attributes, the account is ready for use.

(Fringe Benefit Account Number will be the same as the newly created General Fund Account number)

Should there be any questions, please contact Suzanne Efhan at efhans@hawaii.edu , or (808) 956-2279.

___________________________________________________________________________________________________________________

KFS eDocs

What is a General Error Correction (GEC)?

A GEC is an e-Doc that allows you to make corrections to e-Docs that were previously submitted and approved. GEC’s are used to correct accounts and object codes on Financial Processing (FP) e-Docs or on Payment Requests (PREQ). Please see AP 8.641 Journal Entries

What is a Distribution of Income and Expense (DI)?

A DI e-Doc is used to distribute income or expenses from one account to one or more appropriate account(s), when one account has incurred expenses or received income on behalf of one or more accounts. When you have accumulated income or expense and need to distribute or move it to other accounts, you would use a DI. Please see AP 8.641 Journal Entries

What is an Internal Billing (IB)?

An IB e-Doc is used to bill for goods or services provided by one university department to another university department, reflecting income to the provider and expense to the customer. An IB is not to record the transfer of capital equipment between university accounts, this type of transaction is usually recorded via a Transfer of Funds (TF) e-Doc and a Capital Asset e-Doc. The IB should be processed by the department providing the goods or services since the document does not route to the FA of the income accounting lines. Please see AP 8.641 Journal Entries

What is a Transfer of Funds (TF)?

A TF e-Doc is used to transfer funds between accounts. There are two kinds of transfer transactions, mandatory and non-mandatory. Mandatory transfers are required to meet contractual agreements. Specific object codes are used to identify these transactions. Non-mandatory transfers are allocations of unrestricted cash between fund groups or accounts, which are not required by any external agreements. The most common non-mandatory transfers recorded by the University are transfers of tuition cash from the tuition revenue control account to the college/department expending accounts. Please see AP 8.641 Journal Entries

___________________________________________________________________________________________________________________

RCUH

Why do “7232 RCUH Expense/Advance” payments need to be reclassified in KFS?

In order to properly record the types of expenditures occurring at UH, the advances sent to RCUH for service orders using object code 7232, RCUH Expense/Advance, must be reclassified to an appropriate object code in KFS after the disbursements are made from the RCUH financial system.

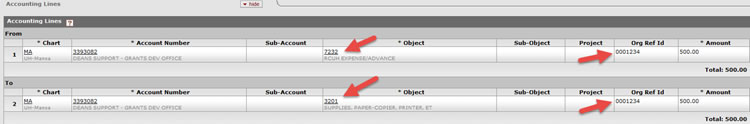

To reclassify, please follow these steps:

- Make sure that the KFS object code corresponds to the RCUH budget category for the amounts disbursed.

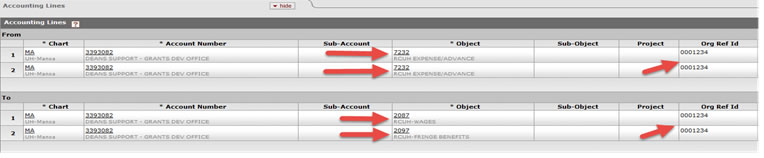

- Use the Distribution of Income and Expense (DI) e-Doc to reclassify the 7232 expense to the proper expense object code. Include the RCUH project number in the Org Ref Id field on the accounting line.

- When reclassifying RCUH wages and fringe benefits, make sure to use object codes: 2087 RCUH-WAGES and 2097 RCUH-FRINGE BENEFITS, respectively.

We encourage you to make the reclassifications as soon as possible after RCUH reports the payments to avoid the additional workload during fiscal year end processing. If you have any questions, please contact the General Accounting Office at uhgalc@hawaii.edu.

Which RCUH Budget Category code should I use for my revolving project revenue?

This is a reminder that revolving fund project revenues need to be properly classified in RCUH between UH and non-UH sources. Sales from one UH unit to another is a recharge activity and is not revenue for UH consolidated financial statement purposes.

- If your RCUH revolving project is billing a KFS account, please use budget category (BC) 0010 or comparable UH income code.

- If you are recording income via RCUH JE, please use BC 0010 or comparable UH income BC.

- If you are receipting a UH check, RCUH check or UH Foundation check, please use BC 0010 or comparable UH income BC.

Sales to non-UH entities should be reported as revenue from sales and services provided.

- Payments received from other state agencies, please use BC 0110 or comparable non-UH income BC.

- Payments received from other Universities or private parties, please use BC 0110 or comparable non-UH income BC.

Please refer to the following table to determine which budget category to use when depositing or recording income in revolving project accounts tracked in the RCUH financial system.

| Budget Category | Use For | Comments |

|---|---|---|

| 0010 | UH income | Income from internal sources: UH extramural accounts (RCUH F/S account range 4nnnnnn and 6nnnnnn) UH intramural accounts (RCUH F/S account range 0007nnn to 0009nnn) Revolving project accounts (RCUH F/S account range 001nnnn, 0001nnn to 0002nnn) UH Foundation accounts |

| 0110 | Non-UH income | Income from all other sources (examples below): State agencies Universities or other organizations RCUH direct projects |

For projects that have sub-sections to track various program activities, UH and non-UH income also needs to be segregated for each section. Please contact Jennifer Chang at jchang@rcuh.com to establish additional budget categories as needed.

If you have any questions, please contact the General Accounting Office at uhgalc@hawaii.edu.

___________________________________________________________________________________________________________________

Transfers

Does it matter which Non-Mandatory Transfer object code I use?

Non-mandatory transfers are cash transactions between accounts that are initiated at the discretion of a governing board or management. These transfers are neither revenue nor expenditures but are for accountability purposes. A “transfer- in” behaves like revenue, while a “transfer-out” behaves like an expenditure.

When non-mandatory transfers are made, they should be recorded in KFS using the Transfer of Funds (TF) eDoc. This eDoc type requires transfer object codes for both the ‘From’ and ‘To’ sides of the financial transaction.

Most Commonly Used Non-Mandatory Transfer Object Codes: Transfer-out (FROM Accounting Line = Decrease to Cash)

| Object Code | Object Code Long Description |

|---|---|

| 1519 | Non-mandatory transfer out to Current unrestricted special funds for other |

| 1529 | Non-mandatory transfer out to Current unrestricted revolving funds for other |

| 1533 | Non-mandatory transfer out to Current unrestricted trust funds for unrestricted quasi-endowment |

| 1534 | Non-mandatory transfer out to Current restricted trust funds for restricted quasi-endowment |

| 1586 | Non-mandatory transfer out to Plant for Renewal & Replacement fund group |

| 1589 | Non-mandatory transfer out to Plant fund group for other |

Transfer-in (TO Accounting Line = Increase to Cash)

| Object Code | Object Code Long Description |

|---|---|

| 1409 | Non-mandatory transfer in from Current unrestricted general funds for other |

| 1416 | Non-mandatory transfer in from Current unrestricted special funds for Renewal & Replacement fund group |

| 1419 | Non-mandatory transfer in from Current unrestricted special funds for other |

| 1429 | Non-mandatory transfer in from Current unrestricted revolving funds for other |

| 1433 | Non-mandatory transfer in from Current unrestricted trust funds for unrestricted quasi-endowment |

| 1434 | Non-mandatory transfer in from Current restricted trust funds for restricted quasi-endowment |

| 1489 | Non-mandatory transfer in from Plant fund group for other |

These object codes are intended to help identify the transfer destination or source account(s). On the FROM accounting line, the object code should describe the account that the funds are being transferred to. Likewise, on the TO accounting line, the object code should describe the account that the funds are from.

If you have any questions, please contact the General Accounting office at uhgalc@hawaii.edu.

___________________________________________________________________________________________________________________

Right to Use Accounting

GASB 87

What happened to Capital and Operating Leases?

The terms “Capital Lease” and “Operating Lease” are no longer used. Under GASB 87, there are two categories of leases:

- Short-Term Leases

- All Other Leases – recorded in accordance with GASB 87, subject to materiality and limited exclusions.

What is a Short-Term Lease?

A Short-Term Lease is an agreement with a maximum possible term of 12 months or less, including any options to extend, regardless of the probability of such options being exercised.

Does a 6-month lease with an option to extend for an additional 12 months qualify as a Short-Term Lease if it is reasonably certain that the option will not be exercised?

No. Short-term agreements are agreements with a maximum possible term of 12 months or less, including any options to extend, regardless of the probability of such options being exercised.

How are leases accounted for under GASB 87?

Lessor Accounting

The lessor records a lease receivable for the present value of payments expected to be received and a deferred inflow of resources based on the lease receivable with certain adjustments. Throughout the lease term, the lease receivable and deferred inflow of resources are reduced, and interest and rental revenue are recognized.

Lessee Accounting

The lessee records a lease liability for the present value of payments expected to be made during the lease term and a leased asset based on the lease liability with certain adjustments. Throughout the lease term, the lease liability is reduced, interest and rental expenses are recognized, and the leased asset is amortized.

How is the lease term determined?

The lease term is the period during which a lessee has a noncancelable right to use an underlying asset, plus the following periods, if applicable:

- Periods covered by either lessor’s OR lessee’s option to extend if reasonably certain will extend.

- Periods covered by lessor’s OR lessee’s option to terminate if reasonably certain will NOT terminate.

When should the lease term be reassessed?

The lease term should be reassessed only if one or more of the following occur:

- Lessor or lessee elects to exercise an option even though it was previously determined that it was reasonably certain they would not.

- Lessor or lessee elects not to exercise an option even though it was previously determined that it was reasonably certain they would.

- An event specified in the lease contract that requires an extension or termination of the lease takes place.

A lease contract has a non-cancelable period of 5 years. At the end of the 5 years, both the lessor and the lessee have the right to cancel the lease or may continue under the same terms on a month-to-month basis. Should the month-to-month holdover period be considered part of the lease term?

No. Since the holdover period is cancelable by either party, it is excluded from the lease term.

How should subleases be treated?

Subleases are treated as transactions separate from the original lease.

How are lease-leaseback transactions treated?

Lease-leaseback transactions are accounted for as a net transaction. Gross amounts are separately disclosed.

___________________________________________________________________________________________________________________

GASB 94

What is a Public-Private and Public-Public Partnership (P3)?

A P3 is an agreement where UH contracts with an operator (governmental or nongovernmental) to provide public services by conveying control of the right to operate or use an asset.

How are P3s accounted for under GASB 94?

At the commencement of the P3 term, the P3 transferor continues to include the existing P3 asset in their financial statements. In addition, the P3 transferor recognizes a receivable for the present value of the installment payments and a deferred inflow of resources. When the P3 asset is placed in service, the P3 transferor recognizes asset additions for the improvements made by the operator and deferred inflow of resources. Revenue is recognized over the term of the agreement in a systemic and consistent manner.

How should P3s with multiple components be accounted for?

Each component should be accounted for as a separate agreement.

What are Availability Payment Arrangements (APA)?

APAs are agreements where payment is based solely on the availability of the asset to perform service, not on the actual performance of services. Payment may be based on the physical condition of the asset, construction milestones, or achievement of availability measures. APAs are not P3s.

What are Service Concession Arrangements (SCAs)?

SCAs are agreements where the transferor conveys the right to use an asset for significant consideration such as an up-front payment, installment payments, and/or a new or improved facility. Under a SCA, the operator collects and is compensated by fees from third parties.

___________________________________________________________________________________________________________________

GASB 96

What is SBITA?

Subscription-Based Information Technology Arrangements (SBITAs) are agreements that convey control of the right to use another party’s information technology software for a period of time in an exchange or exchange-like transaction.

How are SIBTAs accounted for under GASB 96?

The University records a subscription liability for the present value of payments expected to be made during the agreement term and a subscription asset based on the subscription liability with certain adjustments. Throughout the agreement term, the subscription liability is reduced, interest and software license expenses are recognized, and the subscription asset is amortized.

What is a Short-Term Agreement?

A Short-Term Agreement is an agreement with a maximum possible term of 12 months or less, including any options to extend, regardless of the probability of such options being exercised. Short-term agreements are not subject to GASB 96 requirements.

Would a subscription that is paid month-to-month with the option to cancel at any time meet the SBITA guidelines?

No.

Would a computer license agreement that automatically renews be considered a perpetual license?

No. For agreements that are automatically renewed, there is an option to terminate at each renewal date, therefore it is not a purchase. A perpetual license on the other hand is a purchase in which a government is granted the right to use the vendor’s computer software indefinitely.

What happens if the SBITA contract contains software related items and IT support services?

If the contract contains both software subscription and support services, generally each component should be accounted for separately.

Should variable payments that are contingent on future performance or the use of the underlying IT asset be included in the computation of the subscription liability?

No.

How are costs (other than subscription payments) associated with a SBITA accounted for?

- Preliminary Project Stage: The conceptual formulation and evaluation of alternatives, the determination of existence of needed technology, and the final selection of alternatives for the SBITA.

Outlays associated with the preliminary stage should be expensed. - Initial Implementation Stage: Ancillary charges related to designing the chosen path, such as configuration, coding, testing, and installation. Other ancillary charges that are necessary in order to have the initial subscription asset placed into service.

Expenditures related to the initial implementation stage are capitalized in addition to the subscription asset. - Operation and Additional Implementation Stage: This includes maintenance, troubleshooting, and other activities associated with the government’s ongoing access to the underlying IT assets.

Unless they meet specific capitalization criteria, expenditures related to the operational and additional implementation stage are expensed as incurred.

What are the three common cloud computing services?

- Software as a Service (SaaS): A cloud-based service where users can access the software anywhere with an internet connection.

- Platform as a Service (PaaS): A third-party service for software developers that provides the tools in order to create new software.

- Infrastructure as a Service (IaaS): Allows businesses to purchase resources as they are needed, such as storage or servers.