This issue of the Financial Management Office Newsletter includes information about the following:

- Pre-Encumbrance (PE) Reminders

- Preparation for Upcoming FY 2024 Annual Inventory Verification

- OPEB Retro Adjustments

- Quarterly Interest Rate for Late Vendor Payments

- NEW! eTravel State and Country Dropdown Feature

- Disbursing Tip: How do I Cancel an Approved PREQ or DV Awaiting Payment?

- Resources

- Fiscal Administrators Town Hall Meeting

Wednesday May 8, 2024 – 10:00am-11:30am

Webinar ID: 983 2627 1969

Password: 620192

https://hawaii.zoom.us/j/98326271969?pwd=bmw0czlmcVBwWThKanRNcFV3OCtMdz09 - Financial Management Office Training Modules

- Fiscal Administrators Town Hall Meeting

The Financial Management Office Newsletter is distributed monthly. Should you have any questions about this newsletter, contact Amy Kunz via email: amykunz@hawaii.edu.

Subscribe to this FMO Newsletter

Unsubscribe from this FMO Newsletter

___________________________________________________________________________________________________________________

Pre-Encumbrance (PE) Reminders

Target Audience: KFS Users

Pre-Encumbrance (PE) balances should be disencumbered after the goods or services are received and the expense has been recorded in your account. Both the PE encumbrance balance and expense transaction will affect the available balance for your account.

To manually disencumber a PE balance, initiate a PE document and complete the disencumbrance section with the same accounting line information – Chart, Account, Sub-Account, Object Code and Sub-Object Code from the original PE and enter the original PE document number in the Reference Number field.

- The PE document uses the original accounting line information and PE document number to match and disencumber the original pre-encumbrance record in the Open Encumbrance table.

- Do not enter the Interdepartmental Order (IDO) number, Internal Billing (IB) or Service Billing (SB) document numbers, or PEnnnnnnnn (original PE document number prefixed with “PE”) in the Reference Number field.

- You may enter the IDO number, IB or SB document numbers in the Document Overview tab Organization Document Number field or Accounting Lines Org Ref Id field. Character limits are 10 and 8 respectively.

- Any mismatch of the reference number field document number and/or accounting line information will result in a new entry with a negative outstanding amount in the Open Encumbrance table.

- Do not enter a date in the Reversal Date field on the PE disencumbrance document.

- Do not complete any fields in the encumbrance section.

If you are not certain when the goods or services will be provided, do not enter a reversal date on the original PE. Instead, process a manual disencumbrance after you receive the goods or services to prevent duplicate disencumbrance transactions and a negative outstanding amount.

Submit a trouble ticket to request assistance with clearing a negative outstanding amount.

At fiscal year-end, Pre-Encumbrance Outstanding Amounts for:

- Contracts and Grants (CG) accounts (extramurally funded accounts administered by the Office of Research Services) are carried forward to the new fiscal year.

- Non-CG accounts are not carried forward to the new fiscal year.

- If the Non-CG PE encumbrance balance is needed in the new fiscal year, a new PE document should be created in the new fiscal year.

- Do not process a manual disencumbrance for the prior year outstanding amount in the new fiscal year.

For more information regarding Pre-Encumbrances, please review the Pre-Encumbrance User Guide and Financial Processing FAQs.

If you have any questions, please contact the Fiscal Services Office at fissrv@hawaii.edu.

___________________________________________________________________________________________________________________

Preparation for Upcoming FY 2024 Annual Inventory Verification

Target Audience: Fiscal Administrators and Support Staff

Yes, it’s that time of year again and physical inventory of equipment assets will begin in July! Here are some tips to help you prepare:

Run pre-inventory report

Log into JasperReports Server to download an Excel copy of your “Annual Inventory Verification” report to review your current equipment list, with the following steps below:

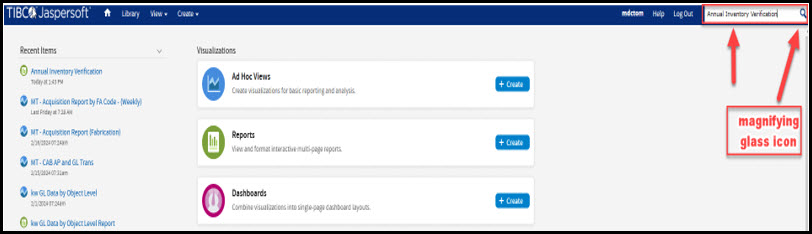

- In the search box, located at the top right-hand corner next to the Log Out, type “Annual Inventory Verification” and click on the magnifying glass icon.

- Click on the report name, “Annual Inventory Verification,” to run it.

- Input Controls box appears.

- Click on the 3-digit FO code (required field), you may select multiple FO codes. Building Location and Asset Rep Username are optional fields, but are useful in narrowing your search.

- Click Apply.

- Click OK.

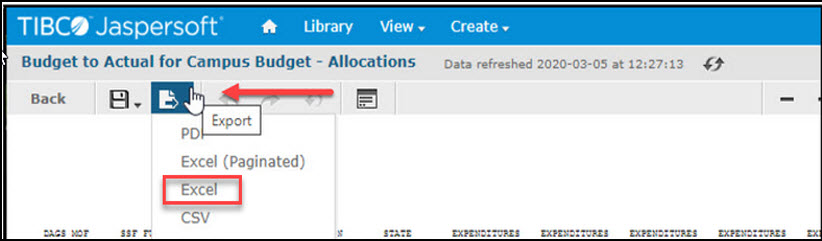

- To export to Excel:

- Click the Export button.

- Select the export format “Excel” from the drop-down.

Review asset information and take action

Ideally, asset information (description, asset representative, serial number, manufacturer, model number, location, etc.) should be updated throughout the year as changes occur. However, it is not too late to process updates as long as they are completed by June 20, 2024. Doing so will help ensure that the updated records are captured for the Annual Inventory Verification Report as of June 30, 2024. Please reference the CAM Training Manual for assistance on how to process appropriate Capital Asset Management (CAM) eDocs in KFS.

Additionally, equipment items that are no longer in use, broken or obsolete should be transferred or retired. Please refer to AP 8.543 – Property and Equipment Transfer and Retirement.

Remind departments of upcoming annual inventory

This will help departments plan ahead with the logistics of conducting the annual inventory such as assigning personnel other than the asset representative to conduct the physical testing, as well as making sure that the buildings and rooms where assets are located, will be available during inventory period.

Please contact CAAO for questions at caao@hawaii.edu.

___________________________________________________________________________________________________________________

OPEB Retro Adjustments

Target Audience: All

The Department of Accounting and General Services (DAGS) advised departments in January that incorrect OPEB rates were assessed for 11 pay periods (August 4, 2023 – January 5, 2024). HawaiiPay’s OPEB rate was set to the 2023 assessment rate of 0.00% during this period. Per the Department of Budget and Finance’s Memorandum 23-09, Interim Fringe Benefit Rates for FY24, the OPEB assessment rate should have been updated to 11.69%.

DAGS began assessing the correct OPEB rate effective with the January 20, 2024 payroll. DAGS developed files to send to UH by pay date and individual employee for the retroactive adjustment. The goal is to have the retroactive OPEB adjustments posted before the end of April to allow time for any corrections that departments may need to make prior to closing fiscal year-end.

It has been brought to our attention that the files received from DAGS include OPEB assessments on Overload pay. The Financial Management Office is working with DAGS to resolve this issue. To most efficiently complete all postings, we will continue to process files as received from DAGS. We are working on a process to do a mass reversal of OPEB assessed on overload pay if it is determined to be appropriate.

For guidance on the impact of retroactive assessments for OPEB on Extramural Awards, please refer to the Office of Research and Innovation’s memorandum dated January 16, 2024.

Retroactive assessments are planned to be posted as follows:

| Posting Date | Pay Date |

|---|---|

| April 8 | 08/04/2023 |

| April 9 | 08/17/2023 |

| April 10 | 09/05/2023 |

| April 11 | 09/20/2023 |

| April 12 | 10/05/2023 |

| April 15 | 10/20/2023 |

| April 16 | 11/03/2023 |

| April 17 | 11/20/2023 |

| April 18 | 12/05/2023 |

| April 22 | 12/20/2023 |

| April 23 | 01/05/2024 |

We anticipate that any transaction that may fail to post through the automated process will be manually recorded by General Accounting by April 26, 2024. However, we will inform you when this process is complete and all files are completely posted and with any updates to the planned posting dates, as necessary.

Jasper reports may be used to isolate retro OPEB adjustments, which will be posted on days other than normal payroll posting dates.

Any adjustments required as a result of the retroactive assessment should be recorded as follows:

- If both salary and fringe are being moved, the Salary Transfer (ST) edoc should be used.

- If you would like to request a LLCP to move fringe only, please complete the LLCP Request Template and email to uhgalc@hawaii.edu.

- The standard closeout procedures for extramural awards remain unchanged. Amounts for any transactions related to this matter must post to the project account(s) in KFS by the project’s closeout confirmation deadline to ORS, or cleared per the VPRI memo dated January 16, 2024.

Should you have questions on processing the above adjustments, please email uhgalc@hawaii.edu.

___________________________________________________________________________________________________________________

Quarterly Interest Rate for Late Vendor Payments

Target Audience: Fiscal Administrators and Fiscal Support Staff

Pursuant to Section 103-10 of the Hawai`i Revised Statutes, the interest rate for obligations related to goods delivered or services performed remaining unpaid after 30 days is equal to the prime rate for each calendar quarter plus two percent. The interest rate is adjusted quarterly using the prime rate as posted in the Wall Street Journal on the first business day of the month preceding the calendar quarter. Please refer here for the 2nd quarter interest rate and calculation.

Should there be any questions regarding this change, please call the Disbursing Office at (808) 956-5535.

___________________________________________________________________________________________________________________

NEW! eTravel State and Country Dropdown Feature

Target Audience: Travelers, Fiscal Administrators and Fiscal Support Staff

Effective April 12, 2024, eTravel will feature state and country dropdown lists for your convenience.

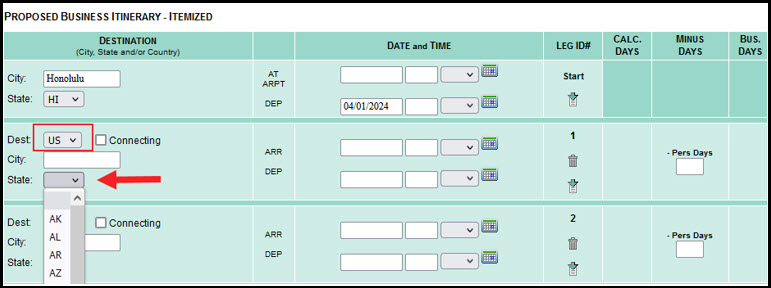

For US destination travel, select the state being traveled to from the dropdown list:

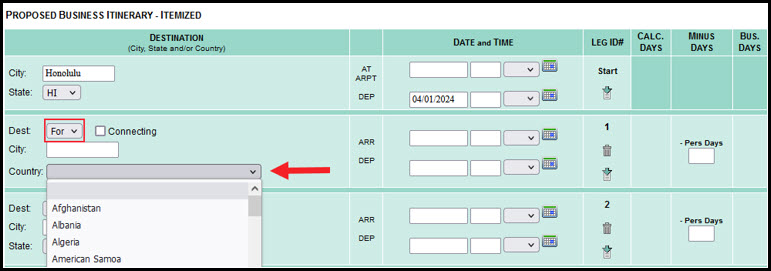

For foreign destination travel, select the country being traveled to from the dropdown list:

Questions can be emailed to etravel-help@lists.hawaii.edu.

___________________________________________________________________________________________________________________

Disbursing Tip: How do I Cancel an Approved PREQ or DV Awaiting Payment?

Target Audience: Fiscal Administrators and Fiscal Support Staff

If an approved PREQ or DV needs to be cancelled, please send your request to cancel the pending payment to hold-checks@lists.hawaii.edu.

In the email, list the following:

- Payee Name:

- Payee ID #:

- Amount:

- KFS Doc #:

- Reason for cancellation:

Request for cancellation must be received before the close of business on the day prior to the Disbursement Date (date the check is to be printed).

Should there be any questions, please call the Disbursing Office at (808) 956-5535.