This issue of the Financial Management Office Newsletter includes information about the following:

- Annual Nonresident Alien (NRA) Assessment for 2025

- Updated DISB WH-1 Form Available for 2025

- Same Day Travel Completions Received After the WIK Deadline

- Reporting of Prize Distribution, Third Party Payments and Research Participant Compensation for Tax Year 2024

- KFS Process Changes Effective January 1, 2025

- JasperReports Server v9 Upgrade

- Resources

The Financial Management Office Newsletter is distributed monthly. Should you have any questions about this newsletter, contact Amy Kunz via email: amykunz@hawaii.edu.

Subscribe to this FMO Newsletter

Unsubscribe from this FMO Newsletter

___________________________________________________________________________________________________________________

Annual Nonresident Alien (NRA) Assessment for 2025

Target Audience: Administrative Officers, Fiscal Administrators, Business Office Staff

To determine if an individual working at the University of Hawai’i on an F-1 or J-1 type visa has been in the USA long enough to qualify as a Resident Alien, the Disbursing Office will be conducting its annual January NRA assessment of all foreign individuals.

The individual benefits from this assessment whereby if they pass the IRS Substantial Presence Test (SPT), the University is no longer required to withhold 1042 taxes from their payments. In addition, providing an updated WH-1 during the annual assessment will facilitate payments and tax forms going to the correct mailing address.

All departmental business offices are required to have their NRA personnel fill out the updated 2025 version of the DISB WH-1 form and attach copies of all supporting documentation as required and listed at the top of the first page of the WH-1.

Please scan the supporting documentation and submit an EDIT vendor request on KFS. The vendor request should list in the DESCRIPTION field the following: FO Code #, NRA Update, LAST NAME. Please remember to review your scanned images before attaching to ensure scanned documents are readable, passport ID or visa numbers and dates are clear to avoid your vendor request being disapproved.

NRA assessments must be completed before a payment can be made each calendar year.

If there are any questions regarding this process, please contact Donnie Feng, Disbursing Office at donnie@hawaii.edu.

___________________________________________________________________________________________________________________

Updated DISB WH-1 Form Available for 2025

Target Audience: Administrative Officers, Fiscal Administrators, Business Office Staff

The DISB WH-1 has been revised and posted to the FMO website. You can find the form at this site page: Payment/Reimbursement -> Forms-Disbursing -> Miscellaneous Forms or click on DISB WH-1.

All previous versions of this form should be discarded. Please update your forms accordingly.

If there are any questions regarding this process, please contact Donnie Feng, Disbursing Office at donnie@hawaii.edu.

___________________________________________________________________________________________________________________

Same Day Travel Completions Received After the WIK Deadline

Target Audience: Administrative Officers, Fiscal Administrators, Business Office Staff

The Wages-in-Kind (WIK) processing deadline for Tax Year 2024 was November 29, 2024. Same Day Travel completions with a $20 allowance will be denied by the Disbursing Office and the department will need to resubmit in January 2025.

If the same day travel includes out-of-pocket expenses (e.g. airfare, car rental, etc.), the Disbursing Office will process the completion provided it does not include the $20 allowance. The $20 allowance can be processed separately in January as a revision.

If there are any questions regarding this process, please email the Disbursing Office at etravel-help@lists.hawaii.edu.

___________________________________________________________________________________________________________________

Reporting of Prize Distribution, Third Party Payments and Research Participant Compensation for Tax Year 2024

Target Audience: Administrative Officers, Fiscal Administrators, Business Office Staff

Payments totaling $600 or more during the Tax Year 2024 will have a 1099 MISC or a 1099 NEC issued. All payments regardless of amount should be reported to the Disbursing Office because these are manually tracked to determine if the $600 threshold has been met to issue the 1099 forms. Supporting documents should be sent via FileDrop to Jan Murakami (jmura) no later than Tuesday, December 31, 2024.

The August 2024 FMO Newsletter has FAQs on these topics.

If there are any questions regarding this process, please contact Jan Murakami, Disbursing Office at jmura@hawaii.edu.

___________________________________________________________________________________________________________________

KFS Process Changes Effective January 1, 2025

Target Audience: KFS Users

UH is preparing to migrate to the Kuali Cloud and the following KFS process changes were announced at the recent FA Town Hall on October 23, 2024. These process changes will go into effect on January 1, 2025. Making these changes now will allow users to get familiar with the new process prior to the system change.

Purchasing Changes

- Remove SuperQUOTE Award Interface – The SuperQUOTE Awards menu item on the Main Menu will be removed. SuperQUOTE data will no longer be auto populated onto the Requisition (REQS). Data can be copied from a SuperQUOTE Award and pasted into the REQS.

- Tip: Data can be copied from the SuperQUOTE Award screen to Notepad first, then to the KFS REQS if there are issues with the display of special characters.

- Tip: Data can be copied from the SuperQUOTE Award screen to Notepad first, then to the KFS REQS if there are issues with the display of special characters.

- Remove Issue by PCard Button – The Issue by PCard button will be removed from the Requisition. All closed requisitions will spawn a Purchase Order. In Concur, there is a UH Purchase Pre-Approval Request form that can be used to obtain prior approvals.

- Remove Justification Requirement on PO – The Justification will become an optional field and will no longer be required for purchases under $2,500.

- Note: PCards are still the preferred method of purchase for goods and services less than $2,500 as outlined in AP 8.266, Purchasing Cards.

Disbursing Changes

- Remove De Minimis Threshold – All DVs will route to the Account Supervisor for approval.

- For Vendor Payee Type Allow Only ONE Invoice per DV – Pre-audit will disapprove any DVs with multiple invoices.

Accounts Receivable Changes

- Invoice Write-Off will be initiated by General Accounting – General Accounting will initiate the Invoice Write-Off (INVW) document once the Office of General Counsel approves the write-off request. The INVW document will route to the FA for approval.

If you have any questions related to these process changes, please contact Amy Kunz at amykunz@hawaii.edu or (808) 956-7161.

___________________________________________________________________________________________________________________

JasperReports Server v9 Upgrade

Target Audience: JasperReports Server Users

JasperReports Server (JRS) was upgraded to v9.0 on 11/18/2024. Thank you for your support and understanding since the upgrade did not go as smoothly as we had hoped.

These are some of the new features with this version.

- Favorites – You can identify ad hoc views, reports and/or global reports as a favorite by either setting the * next to the item or by right clicking on the item and selecting Add to Favorites.

Once the item is added to your Favorites, it will be displayed in your Favorites list on your Home page.

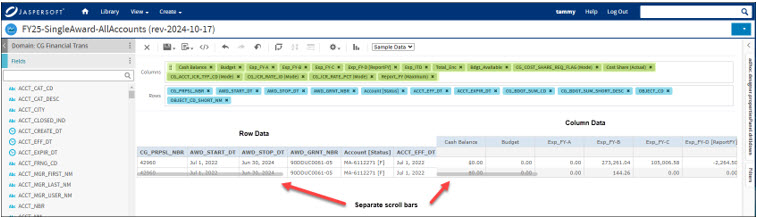

- Crosstabs– The ad hoc designer displays the crosstab rows and columns separately with their own scrollbars if necessary.

- Drill Up and Down the Charts – JRS now offers the capability to drill up and down the charts. You can drill down to move from a higher level of data to a granular level. You can click a data point in a chart that contains hierarchical data to view detailed data.

- Advanced Date Time Calculations – New Date Time functions are introduced for ad hoc calculated fields, you can now perform calculations such as “Year to Date”, “Period to Period”, and “Period over Period”.

To support these calculations, the date grouping function Quarter and Month was renamed to Quarter and Year and the date grouping function Month was renamed to Month and Year. The new date grouping function of Quarter and Month now groups only by quarter or only by month.

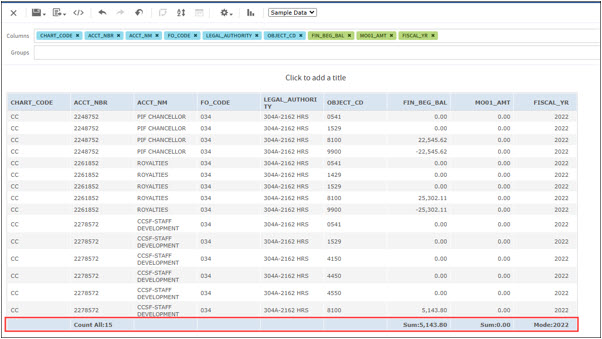

You also have the flexibility to set the Fiscal Year start, providing control over the calculation start point. - Summary Calculation Displayed in Ad Hoc Designer – When summaries are selected, the ad hoc designer will display the summary mode selected (e.g., Sum, Count, Mode, etc.).

For more information, you may refer to the JRS User Guide. If you have any questions about JasperReports Server, please contact the Fiscal Services Office at fissrv@hawaii.edu.