___________________________________________________________________________________________________________________

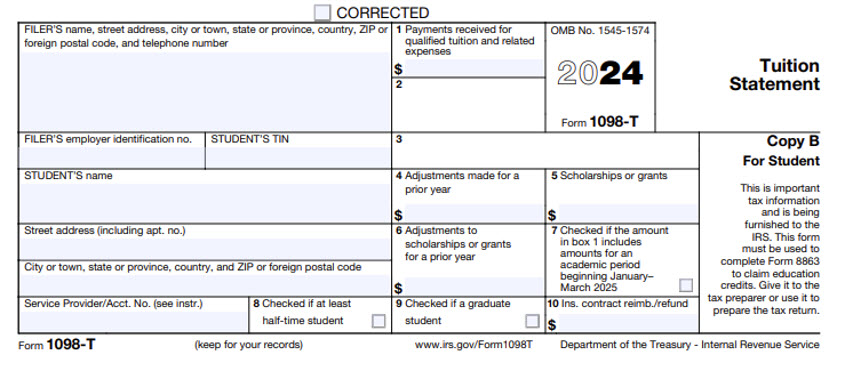

Sample 1098T Form

NEW FOR 2018: Prior to 2018 your 1098-T included an amount in Box 2 that represented the qualified tuition and related expenses (QTRE) the University of Hawaii BILLED to your student account for the calendar (tax) year. Due to a change to institutional reporting requirements under federal law, beginning with tax year 2018 the University of Hawaii will instead report in Box 1 the amount of QTRE you PAID during the year.

All students, except nonresident alien students, who attended a University of Hawaii campus during the 2024 calendar year and paid for qualified tuition and related expenses will receive this form. Forms will be available for viewing in MyUH by January 31, 2025.

The Form 1098-T is the information that colleges and universities are required to issue for the purpose of determining eligibility for U.S. education tax credits when filing annual US income tax returns with the Internal Revenue Service (IRS). Form 1098-T is informational only. Receipt of the Form 1098-T does not indicate eligibility for the tax credit. Please read this page carefully as it explains the information reported on the form.

Box 1: Payments received for qualified tuition and related expenses

Total amount of payments received less any reimbursements or refunds made during the calendar year that relate to the payments received for qualified tuition and related expenses during the same calendar year.

Box 4: Adjustments made for a prior year

Shows any adjustment made for a prior year to payments received for qualified tuition and related expenses that were reported in box 1. This amount may reduce any allowable education credit you may claim for the prior year. See IRS Form 8863 or Pub 970 for more information.

Box 5: Scholarships or grants

Shows the total amount of any scholarships or grants administered and processed by the eligible educational institution during the calendar year. Scholarships and grants generally include all payments received from 3rd parties (excluding family members and loan proceeds). This includes payments received from governmental and private entities such as the Department of Veterans Affairs, the Department of Defense, civic, and religious organizations, and nonprofit entities. The amount of scholarships or grants for the calendar year (including those not reported by the institution) may reduce the amount of any allowable tuition and fees deduction or the education credit you may claim for the year.

Box 6: Adjustments to scholarships or grants for a prior year

Shows adjustments to scholarships or grants for a prior year. This amount may affect the amount of any allowable tuition and fees deduction or education credit you may claim for the prior year. See Pub 970 for how to report these amounts.

Box 7: The amount in box 1 includes amounts for an academic period beginning January-March 2025. (if checked)

If this box is checked, the amount in box 1 includes amounts for an academic period beginning January-March 2025. See Pub 970 for how to report these amounts.

Box 8: Checked if at least half-time student

Shows whether you are considered to be carrying at least one-half the normal full-time workload for your course of study at the reporting institution. If you are at least a half-time student for at least one academic period that begins during the year, you meet one of the requirements for the American Opportunity credit. You do not have to meet the workload requirement to qualify for the tuition and fees deduction or the lifetime learning credit.

Box 9: Checked if a graduate student

Shows whether you are considered to be enrolled in a program leading to a graduate degree, graduate-level certificate, or other recognized graduate-level educational credential. If you are enrolled in a graduate program, you are not eligible for the American Opportunity credit, but you may qualify for the tuition and fees deduction or the Lifetime Learning Credit.

Box 10: Reimbursements or refunds of qualified tuition and related expenses from an insurance contract

Not applicable to UH, applies only to insurers.

Filer’s Information (Upper Left Corner)

Shows the name, address, and phone number of the University. For University of Hawaii students, the following should appear:

University of Hawaii

2600 Campus Rd QLCSS 105

Honolulu, Hawai‘i 96822

phone: (808) 956-0909

Back to top of Sample 1098T Form

___________________________________________________________________________________________________________________

Glossary of Terms

American Opportunity Tax Credit

The American Opportunity Credit is a credit for qualified education expenses paid for an eligible student for the first four years of higher education. You can get a maximum annual credit of $2,500 per eligible student.

Education Credits

Refers to IRS Form 8863. See definition below.

Eligible Dependent

An eligible dependent is a person for whom you claim a dependency exemption. It generally includes your unmarried child who is under age 19 or who is a full-time student under age 24 if you supply more than half the child’s support for the year.

Eligible Educational Institution

An eligible educational institution generally includes any accredited public, nonprofit, or proprietary postsecondary institution eligible to participate in the student aid programs administered by the Department of Education. The University of Hawai‘i is an eligible educational institution.

Eligible Student

You, your spouse, or an eligible dependent can be an eligible student. The student must be enrolled at an eligible educational institution for at least one academic period (semester, trimester, quarter) during the year.

Form 1098-T

Form 1098-T is required to be mailed to all students who were enrolled during the 2021 calendar year. The information reported on the form will help to determine whether the student may qualify for the American Opportunity Tax credit or Lifetime Learning credit. A copy of the form is also being furnished to the IRS.

Form 8863

Form 8863, Education Credits, is used to calculate the eligible amount of the American Opportunity Tax credit and Lifetime Learning credit that can be claimed. This form must be submitted with the taxpayer’s tax return to claim the credits.

Lifetime Learning Credit

The Lifetime Learning tax credit applies to students in undergraduate, graduate and professional degree programs and to students enrolled in coursework to acquire or improve job skills. Students who are not eligible to claim the Hope tax credit may be eligible to claim the Lifetime Learning tax credit. See Publication 970 for more details.

Qualified Tuition and Related Expenses

Includes expenses for tuition and fees required for enrollment or attendance. Fees required to be paid as a condition of enrollment or attendance meet the requirement of qualified tuition and related expenses. Does NOT include books, supplies, equipment, room and board, insurance, medical expenses, transportation, student activities, athletics (unless required for a degree-seeking program), or other similar personal or living expenses.

Tax Credit

A tax credit is subtracted from the amount of taxes you or your family owes. It differs from a tax deduction which is subtracted from your taxable income.

___________________________________________________________________________________________________________________

Form 1098T Electronic Consent and Delivery Information

You consented to receive your Form 1098-T electronically. Tax statements are generally available for viewing from January 31 to October 31 of the current year, for the previous tax year. (Example: Tax year 2015 statements are available from January 31 to October 31, 2016)

Please read the important information below regarding the electronic delivery of your 1098-T:

- An email will be sent to your hawaii.edu email address when the Form 1098-T is available for viewing and retrieval. The subject line of the email will be “IMPORTANT TAX RETURN DOCUMENT AVAILABLE”.

- Electronic delivery of the IRS Form 1098-T remains in effect for the remainder of your time at UH, until one of the following occurs:

- You request to opt-out of electronic delivery of the 1098-T form, or

- The University ceases to provide the option for electronic delivery

- If you wish to opt-out of electronic delivery, you MUST send an email to billpayment-l@lists.hawaii.edu and request to opt out. You will receive an email response confirming your request to opt-out of electronic delivery.

Requests for paper statements are not treated as automatic withdrawals of electronic consent. The withdrawal of consent for electronic delivery does not apply to electronically furnished statements issued before the date of withdrawal of consent takes effect. If you opt-out of electronic delivery, a paper form will be mailed to your permanent address by January 31 of each year. - Paper forms are mailed to your permanent address in the student information system. To ensure receipt of this important tax document, you must keep your permanent address current by either one of the following methods:

- By mail: Download the Student Data Change Form and mail in your updated Permanent Address

- In-person: Fill in the updated Permanent Address on the Student Data Change Form at submit to your home campus Student Records Office.

- No special hardware or software is necessary to view your Form 1098-T. When you agreed to receive your Form 1098-T electronically in MyUH, you confirmed your ability to view the document in the format it will be provided.

- If you need copies of forms from previous tax years, please email billpayment-l@lists.hawaii.edu